Quit smoking — one craving at a time.

CraveLess.Me helps you smoke less without pressure or shame.

Track cravings, build a plan that adapts to you, and keep your data private — on your phone.

Your data stays on your device

People Breathing Easier

Join a community committed to a healthier, smoke-free future.

Quitting is hard. Apps shouldn’t make it harder.

Most quit-smoking apps rely on guilt, streaks, or unrealistic promises. CraveLess.Me takes a calmer approach.

You don’t have to quit overnight.

You don’t have to be perfect.

You just need a system that helps you make better choices — today.

What CraveLess.Me helps you do

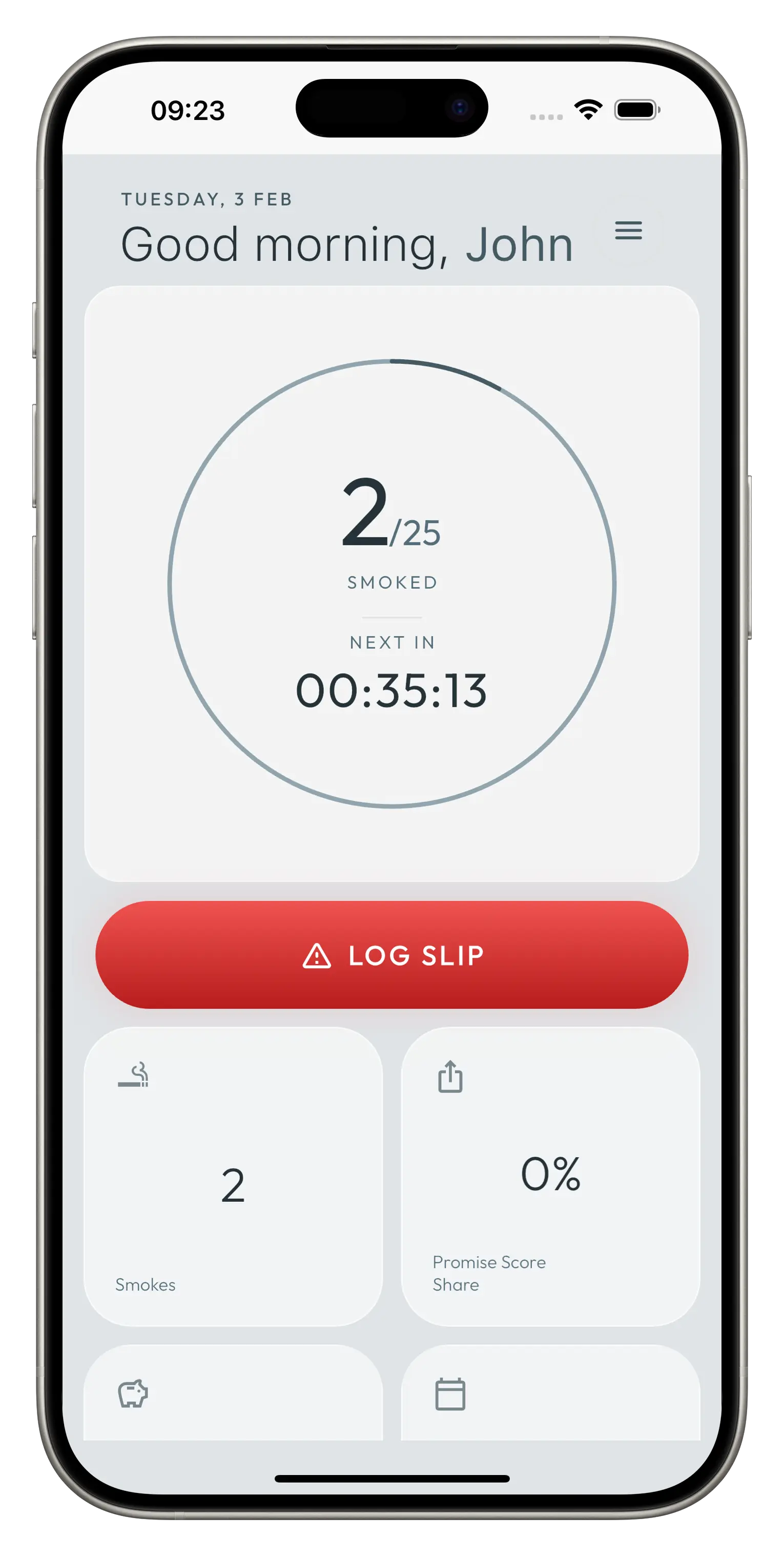

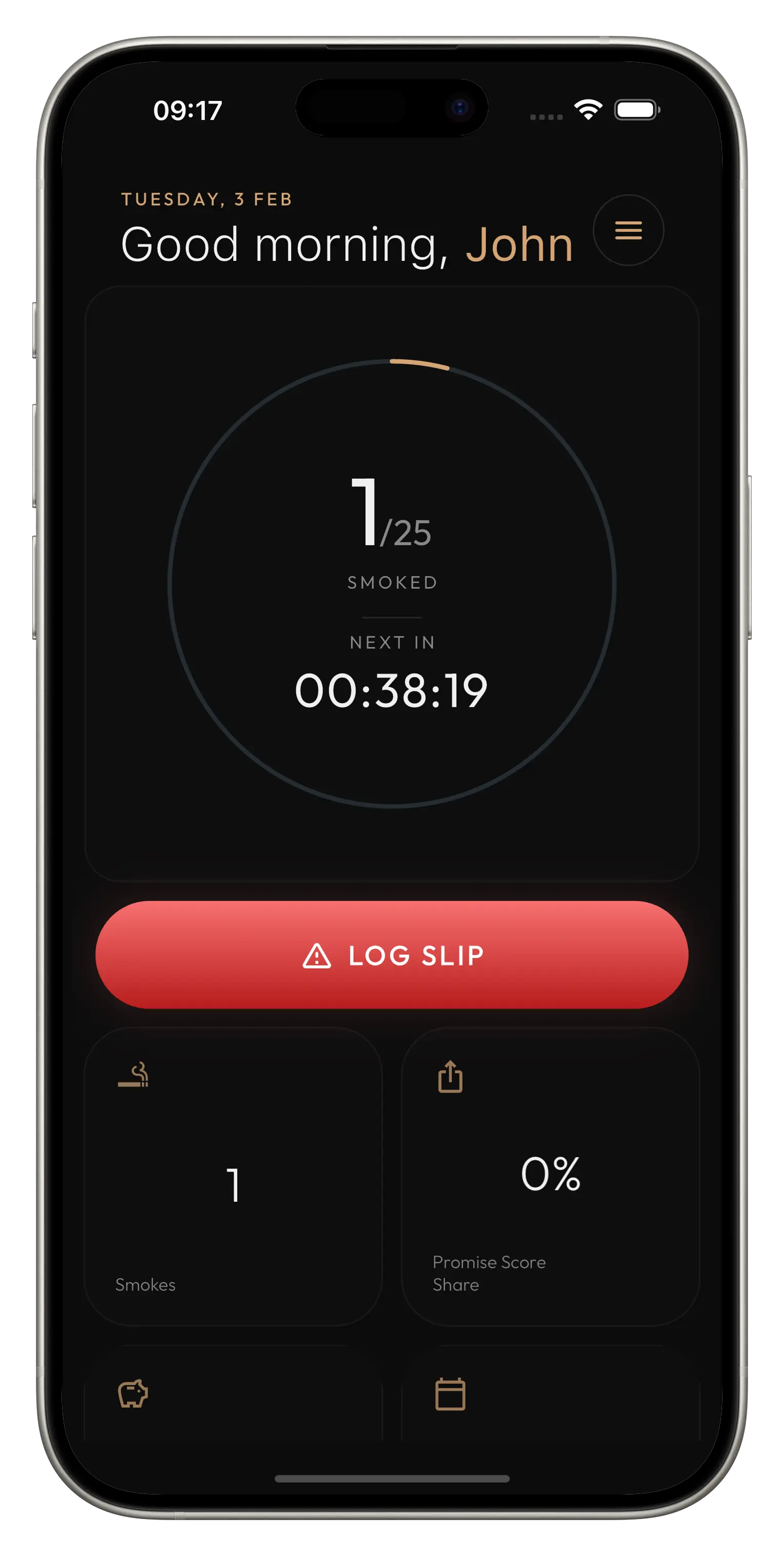

Track cigarettes and cravings

See patterns instead of guessing. Awareness comes before change.

Follow a personalized quitting plan

Your plan adapts based on how much you smoke and how you’re doing — not generic advice.

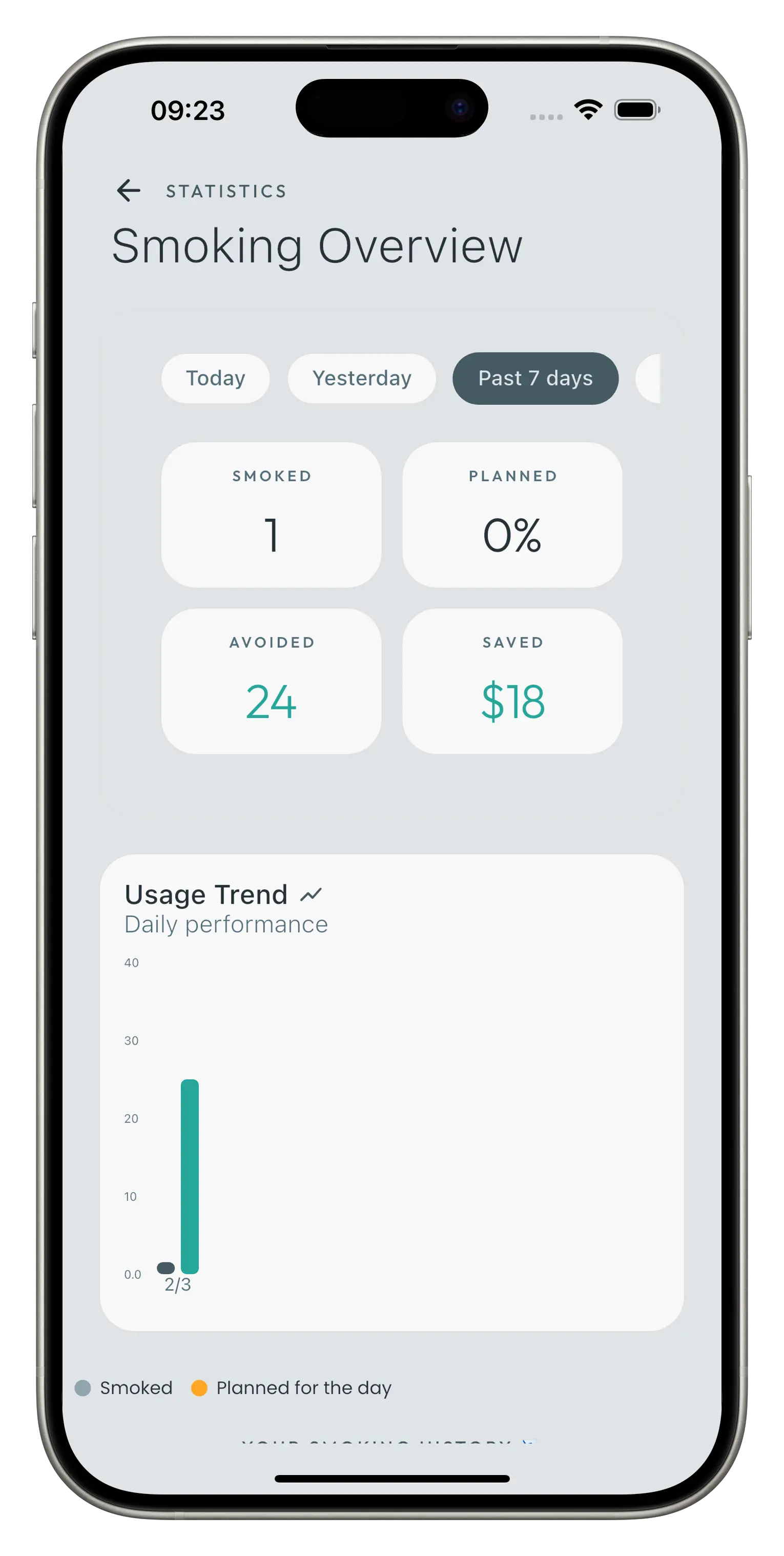

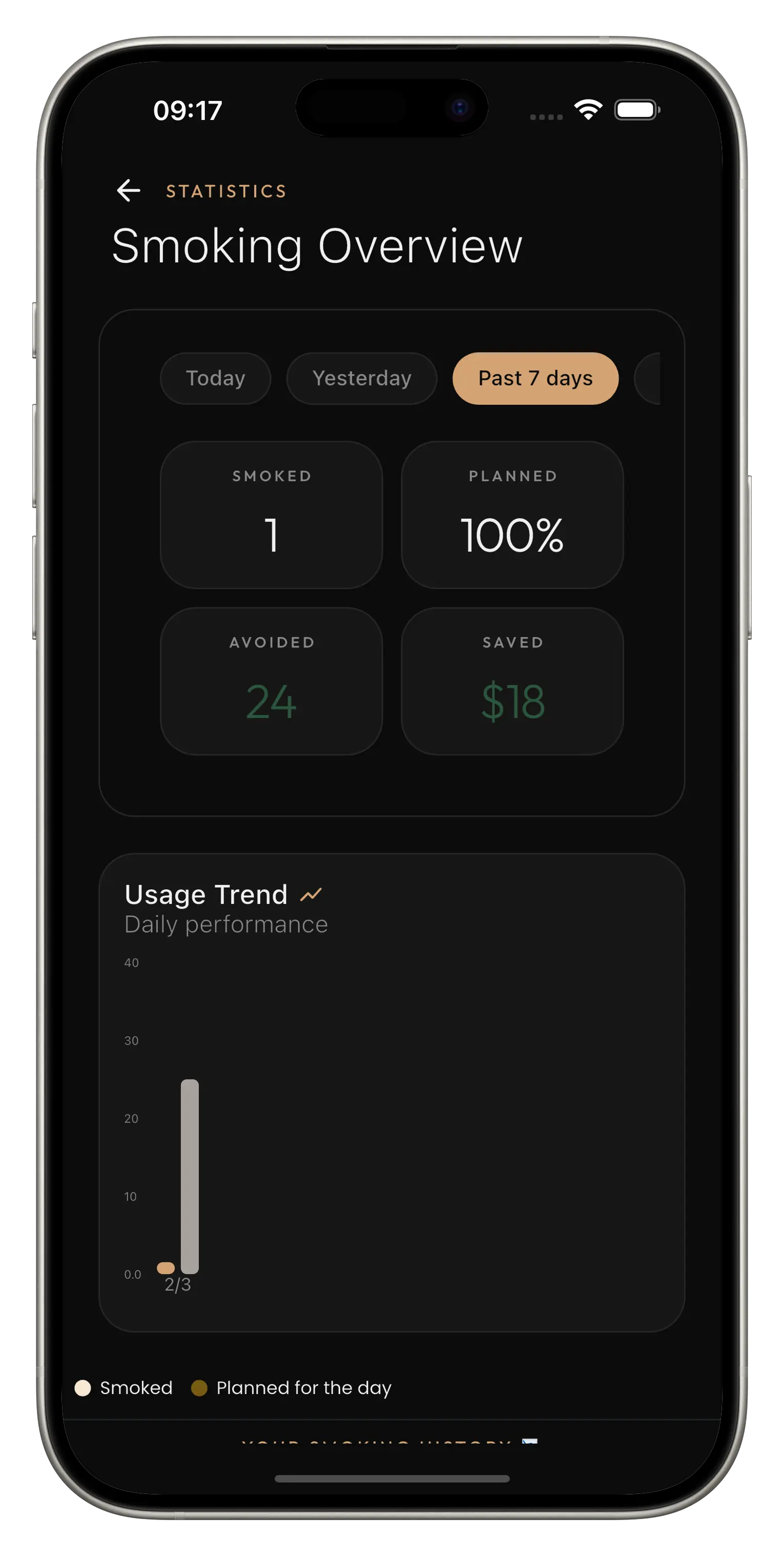

See real progress

Watch cigarettes drop, money saved grow, and milestones unlock.

Prepare for your quit day

Simple tools and checklists so you’re not improvising when cravings hit.

Share progress (optional)

Accountability if you want it — private if you don’t.

Your data is yours. Period.

CraveLess.Me doesn’t sell your data. It doesn’t track you.

Your smoking data stays on your device — not on our servers.

This app is for you if…

You’ve tried quitting before and it didn’t stick

You want to smoke less without feeling like a failure

You prefer calm progress over pressure

You care about privacy and simplicity